I recently previewed the initial release of the 2019 income tax forms. Many of the forms have undergone design changes. There are new lines on existing forms, as well as several new forms that taxpayers may need to complete. For example:

- The most obvious change taxpayers will notice is the form 1040 no longer fits on one page. The 2019 version is now 2 pages.

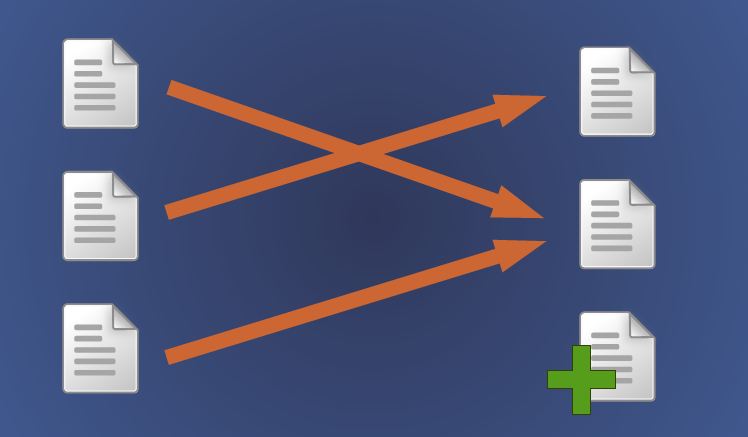

- The 2018 schedule 2 and schedule 4 have now been combined into a revised 2019 schedule 2.

- The 2018 schedule 3 has been merged with the 2018 schedule 5 into a new 2019 schedule 3.

- The form 8867 has been expanded even more for taxpayers claiming the Earned Income Credit, the Child Tax Credit or the College Tuition credits.

- There is a new tax form for senior taxpayers 65 years and older. It is the form 1040-SR. It is optional if you are a senior. You certainly may continue to file the form 1040 instead.

Some forms have been discontinued:

- The 2018 Schedule 6 is no longer included in the 2019 tax returns.

- The Schedule C-EZ has been eliminated for self employed individuals.

There are many other new lines and changes to existing tax forms. What started as a tax simplification process has evolved into anything but. At our office, we are in the process of attending seminars, viewing tax-related webinars, and educating ourselves regarding this year’s changes. It is a challenging process, but we will be ready to guide our clients through the maze of forms and law changes when preparing this year’s income tax returns.